Contents:

As you know, I’m a huge advocate of trading from the higher time frames as they tend to cancel out most of the noise from scheduled and unscheduled news events. There are five things you want to look for when evaluating any inside bar pattern. It’s mostly due to the fact that this particular strategy requires a strong trend in a market that has room to run. Stay tuned for future posts, where I share actual Inside Bar trading strategies and test each one to show you what works and what doesn’t. To get more practice, draw major levels on all of your charts, then go back to them later and see if price ended up respecting those levels. After a few weeks of this exercise, you’ll start to get the hang of it.

- Before trading a trending Inside Bar, be sure that there is a strong trend in place.

- To start tracking Inside Bars on your charts, use one of our handy alert indicators.

- This pattern occurred on the 2nd of February, 2018 when was pretty much the top of the EURUSD.

- In some cases, it is difficult to determine a false breakout of an inside bar, this requires experience.

In this case, the bearish candle represents a broader downtrend, while the bullish candle represents consolidation after the large decline. Truth is, a favorable inside bar setup doesn’t come around often. Of the price action strategies we use here at Daily Price Action, the inside bar is the least common. I used to work at a hedge fund and the largest bank in Hawaii. Now I help traders optimize their trading psychology and trading strategies. Keep in mind that you can make almost any line fit some sort of trend or support/resistance level.

Inside Bar Trading Strategies with Timeframes

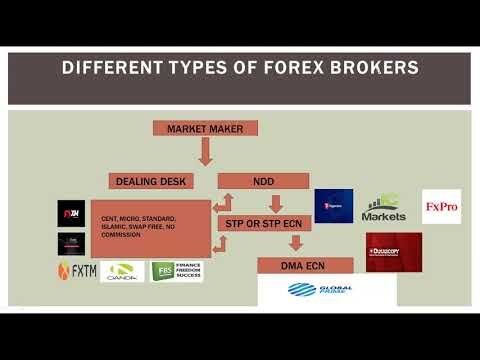

Place a pending sell stop order in case of upward https://trading-market.org/line breakout and pending buy stop order in case of downward trendline breakout. Follow the following steps of inside bar trading strategy 1. I will recommend you go through the previous article on the inside bar patterns to learn these inside bar strategies effectively. There are the following three inside bar trading strategies explained. If you are looking to trade forex online, you will need an account with a forex broker.

Popular Shoreditch bar slapped with £10K fine for having filthy kitchen and mice droppings – My London

Popular Shoreditch bar slapped with £10K fine for having filthy kitchen and mice droppings.

Posted: Wed, 29 Mar 2023 15:50:32 GMT [source]

Sometimes the Inside Bar occurs when there is pressure from sellers and buyers. This shows indecision in the market as both of them were unable to push the price higher or lower. Usually, the presence of the Doji candlestick pattern before the Inside Bar confirms this uncertainty.

How to Draw Trend Lines Perfectly Every Time

Number 3,4 and 5 are all formed in the middle of the trading range and this makes them non-tradable. Based on my experience, once an inside bar is formed, we might see one last spike lower from the following candle. After the close of that candle price quickly reversed and started falling sharply down.

A trading strategy consists of many confluences that make a strategy tradeable. Without confluences, you will not be able to make a profit obviously. The inside bar is the best candlestick pattern and I have used price action with the inside bar candlestick and made the best tradeable strategies. The bullish inside bar setups above formed on the USDJPY daily time frame. Note that this pair was in a strong uptrend leading up to both setups.

But the breakout is not always true, there are false breakouts, the price consolidates near the inside bar. The trader always knows exactly where to place a reasonable stop and limits losses in case of an erroneous entry. The inside bar strategy 2 is composed of a trendline breakout and an inside bar breakout.

In the example below, we are looking at trading an inside bar pattern against the dominant daily chart trend. In this case, price had come back down to test a key support level , formed a pin bar reversal at that support, followed by an inside bar reversal. Note the strong push higher that unfolded following this inside bar setup. Sometimes, when support and resistance or trendline breaks with a big candlestick then price again come back inward the key level.

Nifty Witnessed A Flash Crash But Managed To Close Above 11100 Level

But sometimes, after the breakout, the price again closes inside the key level. The inside bar is only at first glance a simple figure to interpret. Well-executed inside bars don’t show up very often on the chart, so don’t look for them where they don’t exist. If there is no confidence, then it is better not to enter the market. It is recommended to mark the direction of the inside bar, as it sometimes suggests the direction of the price. It is best to enter the trend, although there are cases when the inside bar gives rise to a new trend.

From the chart above you can see what is a good place to place the stop loss. Although there is no rule that is set in stone, most traders tend to place the stop loss just under the previous swing low. I have laid out the rules for inside bar trading as a continuation pattern.

After inside bar indicator has trended up for an extended period, the pause in price movement precedes a reversal of the trend. Therefore, the inside bar is looked at for a short-term trade in the counter-trend direction with the goal of holding the trade for less than 10 bars. As price action trader, we need to learn how to use candlestick patterns like the inside bar properly. If the trend continues, the trader increases his profit, and in case of a reversal, he takes the profit and prepares to enter a reversal. The inside bar is a figure of uncertainty, the participants are not sure about the further movement. The breakout of an extremum means determining the direction, so when the breakout is in the direction of movement, the price accelerates.

This type of Inside Bar appears at support and resistance levels. The inside bar is a popular reversal/continuation candle formation that only requires two candles to present itself. This pattern is a direct play on short-term market sentiment looking to enter before the ‘big moves’ that may take place in the market. The inside bar shows a reluctance of prices to progress above/below the preceding candle high and low indicating market indecision. If the price range of the inside bar is less than 50% of the mother candle, this is an inside bar for a continuation of the trend.

To get more chart patterns that you can test, go here to get the PDF cheat sheet. Before trading a trending Inside Bar, be sure that there is a strong trend in place. That may sound obvious, but many traders are so eager to enter a trade, that they don’t spend a few extra seconds examining the strength of the trend. An Inside Bar is a 2-bar pattern where a bar is inside the total price action of the previous bar. In other words, the Inside Bar has a higher low and lower high than the previous bar. When this happens the previous bar is known as the mother bar.

Inside Bar with a small range

It will take you through the process of identifying the most significant levels on any chart. For many traders, it helps to have a specific definition of a trend. Generally, the stop loss would go on the other side of the mother bar. So if you took a short signal, the stop loss would go above the mother bar. For a long signal, the stop loss would go below the mother bar. You don’t need to know why Inside Bars happen, you just have to understand what the price action is telling you.

Instead, for my Inside Bar strategy, I prefer for the price to make the reversal move first and then form an Inside Bar. That’s not smart because it’s a low probability trade especially when the market is in a “choppy” range. And volatility in the markets are always changing, it moves from a period of low volatility to high volatility . Now, depending on the close of the Inside Bar, this could represent indecision or a reversal in the markets. You can use it to trade with the trend or, market reversals. In theory it is supposed to be a bullish pattern, but practice has proven that on certain occasions it acts as a bearish harbinger.

It’s a pattern that forms after a large move in the market and represents a period of consolidation. This is why trading this pattern can be so profitable – you are essentially buying or selling a breakout, or continuation of the preceding trend. Inside bars signal continuation or reversals, which makes this trading pattern more complex.

Price action becomes “compressed” into a tighter range and at some point, it has to break out and resume normal volatility. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

An InSide Bar is a candle that is essentially “covered” by the previous candle. When you see this type of candle, it usually means that there has been reduced volatility within markets. The InSide Bars are not all equal in terms of size and range, and it is important to keep this in mind throughout your analysis. This will be explained further below in our What to look for section. As the name implies, an inside bar forms inside of a large candle called a mother bar.

Big institutions and big traders are deciding either to upward or downward. Self-confessed Forex Geek spending my days researching and testing everything forex related. I have many years of experience in the forex industry having reviewed thousands of forex robots, brokers, strategies, courses and more. I share my knowledge with you for free to help you learn more about the crazy world of forex trading! Inside Bar Candlestick Pattern on a chartThe Inside Bar can have several inside bars within its range.

An inside bar that forms on the higher time frame has more “weight” simply because the pattern took more time to form. This means more traders were actively involved in its formation, which as a result equals higher capital flows. As you may well know, markets spend most of their time consolidating or ranging, so finding a favorable inside bar setup within a trending market can be a challenge.