Contents:

Each such statement shall be certified by an officer of the LICENSEE as being true, correct and complete. Concurrent with the submission of each such report, LICENSEE shall pay TUFTS any royalties due for the calendar quarter covered by such report. Trade mark rights and royalties are often tied up in a variety of other arrangements. Trade marks are often applied to an entire brand of products and not just a single one. When the rights of trade mark are licensed along with a know-how, supplies, pooled advertising, etc., the result is often a franchise relationship.

An inventor or original owner may choose to sell their product to a third party in exchange for royalties from the future revenues the product may generate. For example, computer manufacturers pay Microsoft Corporation royalties for the right to use its Windows operating system in the computers they manufacture. Sometime, there may be stoppage of work due to conditions beyond control like strike, flood, etc. in this case, minimum rent is required to be revised as provided in the agreement.

Licensing During Disruption: How Licensing Can Serve the Auto Industry as it has Served Others

Although each contract is different, a 20%-30% reserve held for three to four periods is not uncommon. Some publishers automatically withhold a reserve on every new book, while others make a title-by-title decision based on the type of book . Since the reserve is still a liability, albeit a deferred one, it should not be netted from the total Royalties Payable liability account. The monthly entry consists of a debit to royalty expense, which is part of the cost of goods sold, and a credit to the royalties payable liability. This entry can be either an estimate calculated as a percentage of sales based on historical data or an actual figure provided by the publisher’s automated royalty system. Our royalty accounting services stretch from accurate bookkeeping, to royalty tracking, payment automation, and financial reporting.

- In these times especially, we’re extremely grateful for the difference eddy.app has made for our label and our artists.

- However, this becomes a supervisory task when the mark is used in a franchise agreement for the sale of goods or services carrying the reputation of the mark.

- If 20,000 books are sold within this period, then the author would receive a total of $25,000 in royalty payments (10,000 x $1 + 10,000 x $1.50).

Automate your music royalty accounting and build stronger, more trusting relationships with your artists. We offer a viable solution for any company that is required to process music, home video, film, publishing or video game royalty and participation statements. The amount is accrued if the payment is going to take place after the end of the financial period. Different royalty agreements are going to have varying terms, however, royalties can be earned in perpetuity or over a set period of time.

Working With Licensing Agents and Consultants

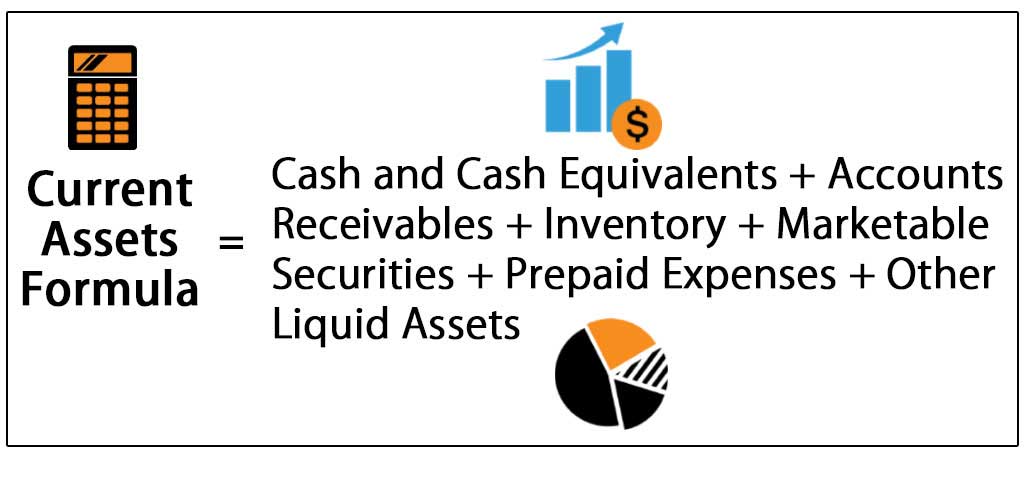

Royalty is payable by a user to the owner of the property or something on which an owner has some special rights. A royalty agreement is prepared between the owner and the user of such property or rights. If payment is made to purchase the right or property that will be treated as capital expenditure instead of a Royalty.

Where https://1investing.in/ are less than minimum rent and shortworkings are recoverable in next years. Shortworking will be shown on the asset side of Balance sheet up to allowable year of recouping after that it will be transferred to profit & loss account . An Author or publisher; lessee or patentor who takes out rights from the owner on lease against the consideration is called tenet.. Patent Royalty − Patent royalty is paid by the lessee to lessor on the basis of output or production of the respective goods. Distributor Statements/Portal Login – We will interface, reconcile, and ingest your sales data.

pricing, and service options subject to change without notice.

Another example would be a computer manufacturing company obtaining the rights to use an operating system, such as Windows. If this was the case, they would pay Microsoft Corporation a royalty percentage to use the operating system in the computers that they manufacture. Royalty payments are tax reportable and are reported according to the IRS instructions on the IRS Form 1099-MISC, Miscellaneous Income.

With eddy.app, you’ll be managing margins, profits, and losses all from one place. Benchmark artists and releases while evaluating your label’s ROI with our comprehensive music royalty accounting software. Note that the buyer of intellectual rights would simply stop selling non popular items, and as result no royalty payment will be needed and no accounting entries are expected to be posted in the books of the licensee .

The term “royalty” also covers areas outside of IP and technology licensing, such as oil, gas, and mineral royalties paid to the owner of a property by a resources development company in exchange for the right to exploit the resource. In a business project the promoter, financier, LHS enabled the transaction but are no longer actively interested may have a royalty right to a portion of the income, or profits, of the business. This sort of royalty is often expressed as a contract right to receive money based on a royalty formula, rather than an actual ownership interest in the business.

An individual can pay to open a restaurant franchise, McDonald’s or Kentucky Fried Chicken, for example. A franchisee of the McDonald’s Corporation has a typical initial investment of one to two million dollars, which includes an initial franchise fee of up to $45,000 paid to the McDonalds corporation. Draft a license agreement that spells out the particulars as stated in this article. Visit your attorney and request or demand an accounting as the case may be. If you are entitled to the royalties you are entitled to an accounting. The rent, paid to the landlord for the use of land or surface on the yearly or half yearly basis is known as Ground Rent or Surface Rent.

Royalty payments are made according to carefully constructed contracts, so it’s important to employ an accurate accounting system to keep track of them. This ensures that payments are rendered in a timely manner and in the correct amount. Accounting processes vary based upon the nature of payments made and other contract stipulations, so it’s important to know the specific entries required for each type of transaction.

We bring together a team of experts with intimate knowledge of all areas of the music business – finance, accounting, technology, and operations. The business analytics and reporting module includes IPM business views, dashboards, KPIs, ad-hoc reporting, data warehousing, and IP usage tracking. The platform enables you to design, plan, assemble and deliver master content and products—while maintaining full insight into the cost of production & distribution and rights availability of all content elements. Since members of our staff have many years of experience in processing royalties, we know where problems arise and how to handle them. We can track and allocate all of your expenditure and revenue, in any currency, then automatically run through your disbursement waterfall to give you an exact overview at anytime on your asset recoupment and disbursements.

New Tax Changes in India for FY 2023-24 Under the Finance Act … – India Briefing

New Tax Changes in India for FY 2023-24 Under the Finance Act ….

Posted: Mon, 03 Apr 2023 07:00:00 GMT [source]

You should understand what post closing trial balance are if you create intellectual property or are working for a business that does in order to be able to make informed judgments. A completed and signed IRS Form W-9 should be attached to the payment request form and supporting documentation (PIR, DP, P.O., etc.). An invoice or other supporting documentation should be provided with the payment request form (PIR, DP, P.O., etc.). Use a UW payment request form and supporting documentation (PIR, DP, P.O., etc.). The latter is more than mere access to secret technical or a trade right to accomplish an objective.

Financial Accounting – Royalty Accounts

Music royalties come from copyright or intellectual property and the owner is paid before stockholders, company executives, etc. Greenlight Financial can help artists calculate how much royalties are due to them. We can also help small record labels when calculating the royalties due to their songwriters. The next diagram shows the sequences in the licensing of performances and the royalty collection and distribution process in the UK. Every song or recording has a unique identity by which they are licensed and tracked.

Monica Uscategui Launches New Music Royalty Division at … – GlobeNewswire

Monica Uscategui Launches New Music Royalty Division at ….

Posted: Thu, 10 Nov 2022 08:00:00 GMT [source]

Amount of royalty charge to profit and loss account will be Rs. 1,000,000/- and balance amount of Rs. 100,000/- will be deposited in the credit of central Government account. Royalty Solutions Corporation understands these challenges and offers a variety of label services to prioritize your royalty processing. RSC is the answer to processing royalties rather than having an in-house royalty department. Our staff is fully trained and dedicated to royalties and will ensure that everything is accounted for properly. Eddy.app turned out to be an ergonomic solution for processing our sales and creating royalty statements. Thanks to regular and thorough customer care, we have been able to adapt the platform to our needs.

Premium and Interactive Webcasting are personalized subscription services intermediate between pure webcasting and downloading. UK legislation recognizes the term online as referring to downloading digital files from the internet and mobile network operators. Offline is the term used for the delivery of music through physical media such as a CD or a DVD. Both broadcasters involved in webcasting and pure-Internet non-broadcasters are required to pay these royalties under the rules framed under the Act. All webcasters are also required to be registered with the United States Copyright Office.

29€ $ DIY label Everything you need to create statements for as many artists as you want, with the ability to process sales from up to 5 royalty sources. Doing royalty accounting was always a nightmare, we were dreading each time it had to be done but eddy.app has really made a difference for us. Eddy.app allows you to easily report music royalty revenues from all of your royalty sources, for all your artists, all at once.

Barrick On Track to Achieve 2023 Targets – Barrick Gold Corporation

Barrick On Track to Achieve 2023 Targets.

Posted: Thu, 13 Apr 2023 11:02:31 GMT [source]

For example, if the carrying amount of a royalty asset exceeds its recoverable amount by $100, then impairment is posted in the books of the intellectual rights owner . Let us assume the subsequent royalty payment is 6% of net income of $10,000 paid quarterly. At the end of the quarter, royalties due are calculated by multiplying net income of $10,000 by 6%, which is $600 . After the prepayment is exhausted, the licensee’s cash balance is credited . The person, or third party, that enters into the licensing agreement would pay royalties back to the creator, or licensor. When it comes to a licensor, the royalty agreement would allow other companies or third parties to use their product or service, ultimately providing them access to a new market.